Buying a home is a dream for many foreigners and immigrants — including those who don’t yet have a Social Security Number (SSN).

A common question is: can someone with only an ITIN number buy a house in the U.S.? The answer is yes! But the process requires planning, specific knowledge, and close attention to details.

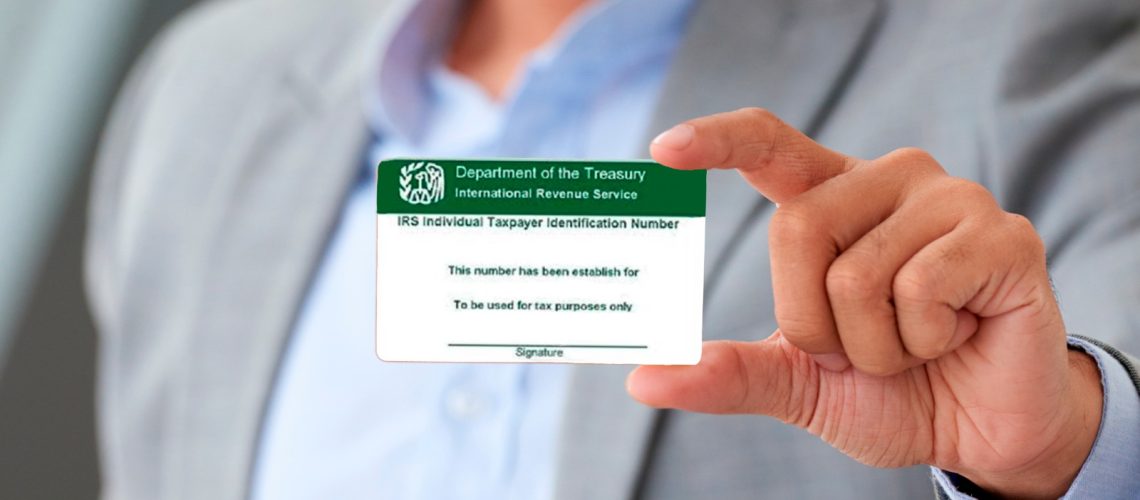

What is the ITIN Number?

The ITIN (Individual Taxpayer Identification Number) is a tax identification number issued by the IRS for individuals who are not eligible for a Social Security Number (SSN) but still need to file taxes in the U.S.

It’s commonly used by:

- Immigrants without legal status but living and working in the U.S.

- Foreigners who have business or property in the country

- Dependents of U.S. citizens

- International investors

Important: The ITIN is not a migration document and does not grant work authorization or government benefits. However, it is recognized for tax and financial purposes — including real estate purchases.

Can You Buy Property with an ITIN?

Yes, the U.S. does not require citizenship or a specific visa to buy property. Real estate is considered private property, and anyone can legally own it.

The biggest difference is in the financing process. While many traditional banks won’t lend to buyers without an SSN, there are lenders that specialize in helping immigrants with an ITIN.

ITIN Financing: How It Works

Financing a home with an ITIN is a viable option for immigrants who want to own a home — even without formal immigration status. However, this type of loan comes with different requirements:

1. Down Payment

Lenders often require between 10% and 20% down. In many cases, 15% is the minimum to show financial commitment.

2. Higher Interest Rates

Since this type of loan presents more risk to lenders, interest rates tend to be higher than for conventional loans.

3. Proof of Income

Even without an SSN, buyers must demonstrate financial stability, which may include:

- Tax returns

- Employer letters

- Bank statements

- Work contracts (even informal)

- Rental history

Which Lenders Offer ITIN Loans?

While traditional banks are usually more restrictive, many credit unions, community banks, and private lenders offer loans specifically for ITIN holders. Options may include:

- Local lenders who work with immigrant communities

- Financial institutions offering ITIN mortgage loan programs

- Banks like First National Bank of America, ACC Mortgage, Dream Home Financing, and others

Tip: Working with a real estate agent and loan officer experienced in ITIN transactions can help you find the best opportunities.

Commonly Required Documents

To buy a home with an ITIN, you’ll typically need:

- A copy of your ITIN letter issued by the IRS

- A valid passport (or other accepted ID)

- Proof of U.S. residence (utility bills, for example)

- Proof of income: pay stubs, bank statements, tax returns (1040)

- At least two years of tax returns filed with the ITIN (when applicable)

- Rental payment history, if available

Some lenders may also request reference letters or documents proving good financial habits.

Benefits of Buying with an ITIN

Despite the challenges, buying with an ITIN offers many advantages:

- Asset building: Real estate appreciates over time and can generate rental income

- Family stability: You’re investing in something of your own instead of renting

- Financial history: Successfully paying off a mortgage with ITIN builds your credit

- Investment opportunity: Ideal for long-term or short-term rental income

Challenges and Considerations

There are also some important points to be aware of:

- Higher interest rates and upfront costs

- Less flexibility in loan conditions

- Risk of scams or financial traps due to lack of knowledge

- The ITIN must be valid and active with the IRS

Another key point: Keep your taxes current — your tax returns are critical for loan approval.

Bonus Tip: Plan Beyond the Purchase

When buying a home, also consider the post-purchase costs, such as:

- Property taxes

- Home insurance

- Maintenance expenses

- Potential renovations or furnishing costs

Keeping an emergency fund and staying compliant with local laws will help protect your investment.

Ready to Own a Home in the U.S.?

Yes, buying a home with an ITIN is possible, and more immigrants are achieving this goal every year.

MGN Fine Homes has extensive experience helping foreign buyers and immigrants, including those with only an ITIN.

If you’re ready to take the next step, or still have questions, get in touch with our team today and find out how we can help you achieve your goals.